Predicting the future might be impossible—but predicting your revenue doesn’t have to be. Revenue forecasting is a powerful tool that helps businesses anticipate income, make smarter decisions, and navigate uncertainty with confidence. Whether you’re a growing firm looking to scale or an established organization managing complex pipelines, accurate forecasting can mean the difference between missed targets and sustainable growth.

In this article, you will learn:

- What is revenue forecasting?

- How to do revenue forecasting?

- What is the ideal revenue forecasting process?

- What are the best revenue forecasting models?

- What are the expert tips for revenue forecasting?

What is Revenue Forecasting? Definition

Revenue forecasting is essentially estimating company’s profits and growth based on the information on the business you already have, as well as the historical data.

In other words, revenue forecasting allows you to predict critical financial metrics, such as margin, profitability, spendings, and more. It can also act as a base for sales forecasts.

Why Is Revenue Forecasting Important?

Revenue forecasting is crucial for professional services companies because it enables better financial planning, resource allocation, and strategic decision-making in various market conditions. Key benefits of predicting the future revenue growth include:

- Cash Flow Management – Helps ensure sufficient liquidity for operations and growth.

- Resource Allocation – Aids in staffing and workload distribution to meet client demands efficiently.

- Budgeting & Investment – Supports informed budgeting and investment decisions for expansion or technology upgrades.

- Risk Mitigation – Identifies potential revenue shortfalls early, allowing proactive adjustments.

- Client & Project Planning – Aligns sales pipelines with capacity, avoiding overcommitment or underutilization.

Additionally, accurate forecasting also improves profitability and stability by providing a clear view of future revenue trends, allowing managers to adjust their sales strategies to current market trends.

How To Do Revenue Forecasting?

Revenue forecasting brings about numerous benefits. However, to enjoy them, you need to complete the forecasting process for a given time period. Let’s see what’s hidden in it for a typical service company.

Choose the right tool for the job

You have to start with basics – and you don’t want to start an endless Excel sheet with revenue forecast you cannot really understand. That’s why you need a project management tool to help you.

Before you make a decision, keep in mind that not all of such tools include finances and historical revenue data in their scope of features. In fact, many of them focus only on resource management or time tracking. However, a typical project-focus business needs more to create an accurate resource forecast and make forecasted revenue as accurate as possible.

Add all the projects to the equation

A typical service company has numerous endeavors to consider while budgeting. Some of them include more than just labor costs; when forecasting, we also need to account for such external factors, including project and company overheads. But which external and internal factors should we consiter in our forecasting tools?

What information should be included in estimates?

At this stage of the revenue forecasting process, you need to gather the information on all the sources of incomes and costs in the company. That includes current and historical data on:

- Future revenues from all sources,

- Billable and non-billable projects,

- Costs of different types of employment,

- Company overheads (i.e. costs of recruitment, equipment, technologies, offices, etc.),

- The costs of support departments,

- Planned purchases and investments,

- Total revenue from previous time period based on historical data.

If you had done a good job in the previous step, your project expense tracker should have a feature that allows you to specify all the costs any project manager can think of, including past revenue data, estimate revenue, and numerous independent variables, making forecasting revenue easier.

Use regression analysis in resource forecasting

Regression analysis is a statistical technique used in resource forecasting to identify relationships between different variables and predict future resource needs based on historical data. It helps professional services firms analyze trends, patterns, and dependencies that influence resource demand.

How Regression Analysis Works in Resource Forecasting

Regression analysis examines the relationship between dependent variables (e.g., required workforce hours, project workload) and independent variables (e.g., project size, client demand, seasonal trends). By identifying these correlations, firms can make data-driven decisions about staffing, project planning, and capacity management.

Types of Regression Analysis Used in Resource Forecasting

- Linear Regression – Used when resource demand has a steady, linear relationship with another factor, such as increasing resource needs as project size grows.

- Multiple Regression – Considers multiple influencing factors simultaneously, such as project complexity, past workload trends, and client-specific requirements.

- Time Series Regression – Incorporates time-based patterns, such as seasonal fluctuations in demand, to forecast future resource needs.

- Logistic Regression – Useful for forecasting categorical outcomes, like whether a project will require additional staffing or not.

Choose the right revenue forecasting model

What are the types of revenue forecasting models?

There is not a single revenue forecasting process that fits all types of professional services companies. To ensure more accurate revenue forecasts, you should choose a model suited to the individual specifics of your company, as well as your revenue forecasting software.

Common forecasting methods for products or services include:

- Pipeline revenue forecasting model,

- Backlog revenue forecasting model,

- Bottom-up revenue forecasting model (or resource-driven),

- Revenue forecasting through historical performance and effects of change.

In reality, organizations will mix and match various models to develop the most accurate forecasting method they can. Given that there are many different ways to forecast revenue using predictive analytics, here are a few of the most common revenue forecasting methods.

The Pipeline Revenue Forecasting Model

The pipeline revenue forecasting model involves tracking and measuring the organization’s future sales. The idea being that some percentage of the sales forecast will turn into real work and future sales. The tricky part with this approach is trying take an educated guess around what the size of each deal will be, and what the “some percentage” of the pipeline is. Many organizations will use the percent likelihood of an opportunity, represented by the stage it is in, to factor the total revenue forecast.

That being said, it is usually not until much later in the sales process that a reasonable estimation for size and duration is made. This limits how far into the future this type of forecast can reach.

The Backlog Revenue Forecasting Model

Similar to the pipeline approach, using your backlog for financial forecasting involves looking at the total amount of revenue that your organization has contracted but has not yet earned. When using backlog as a revenue forecasting model, you don’t need to worry as much about factoring for uncertainty, but rather realistically distributing the revenue growth and future sales over time. This distribution can be done by calculating the typical run rate of your team for a given period and dividing that into the total revenue figure.

This calculation will represent about how long it will take the organization, at its current size, to earn what is currently in the backlog. This approach works well when a high-level view of the growth rate is all that the organization requires. It also assumes the organization has a historical track record of delivering work very similar to what’s in the backlog and will encounter no external factors affecting its performance. Quite often, professional services organizations will sync their backlog with their pipeline to build a more holistic, long term revenue forecast.

The Resource-Driven Revenue Forecasting Model (Or Bottom-Up Forecasting)

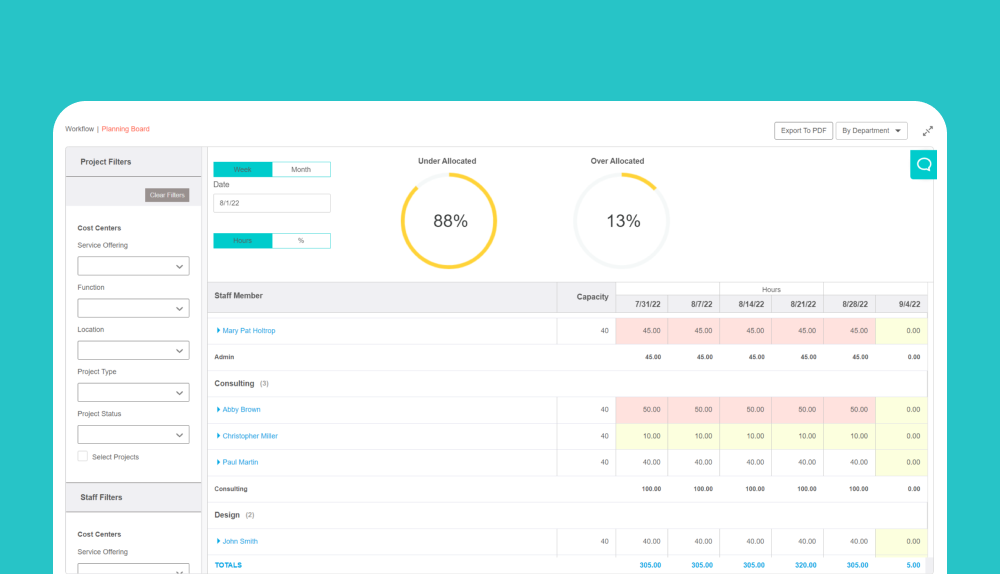

Resource-driven forecasting, also known as bottom-up forecasting, allows teams to schedule all of their planned work and match the right resources to projects accordingly, using resource scheduling software and their best judgement. Planned work includes both projects in the proposal phase and also projects currently underway. Then, an organization can translate the scheduled work into accurate, time-phased revenue forecasts, providing insight into an organization’s capacity to successfully deliver the work within the estimated time of completion.

This transparency provides teams with a clear understanding of the project pipeline but also allows resource schedulers to mindfully balance resources across the organization’s project workload. Resource-driven forecasts should be monitored on an ongoing basis and adjusted accordingly to highlight capacity shortfalls and surpluses, call attention to projects that are both ahead and behind schedule, and incorporate new work that enters the sales pipeline.

Revenue Forecasting Through Historical Performance and Effects of Change

For organizations that run a recurring revenue business model, such as managed service providers, this approach may work well. It involves assuming the organization will earn at least the same amount of revenue this current period as it did during the same period in the past. With historical performance as a baseline, current conditions are then analyzed to assess how they may affect that performance. Winning or losing a major client, introducing a new service line, or outside market factors are all examples of events that should be taken into account.

Strengths

- Can be performed quickly.

- Takes into account market factors in addition to backlog and pipeline.

- Can be performed in tandem with other approaches.

Weaknesses

- Requires in-depth understanding of the firm, and the market it operates in.

- Needs to be consistently assessed for accuracy.

- Doesn’t highlight capacity requirements.

- Not appropriate for traditional services business models.

Key Takeaways: Revenue Forecasting

While might seem complicated at first, the forecasting process is undobtedly the key to higher future sales and future revenues. Still, while there are some independent variables that might alter the process, there are a few things that are the key to its succes. They include:

- Data-Driven Approach – Use historical revenue data, market trends, and sales pipeline insights to build accurate forecasts for your revenue streams. Relying on intuition alone can lead to costly errors.

- Dynamic and Continuous Updates – Revenue forecasting should not be a one-time exercise; it needs regular updates based on real-time data, changing client demands, and economic shifts.

- Scenario Planning – Incorporate best-case, worst-case, and most-likely scenarios to prepare for potential fluctuations in revenue and mitigate risks.

- Alignment with Sales & Delivery Teams – Ensure sales, finance, and project delivery teams collaborate, as discrepancies between pipeline expectations and actual capacity can impact forecast accuracy.

- Consider Market & Economic Conditions – External factors like industry trends, economic downturns, and competitor activity can influence revenue and affect your cash flow. Adjust forecasts accordingly to stay proactive and predict future accurately.

- Account for Project Delays & Cancellations – Recognize that not all deals will close as planned, and some projects may be delayed or canceled. Build a buffer to prevent overestimations in revenue forecasting.

- Client Payment Cycles Matter – Understanding client billing and payment terms helps improve cash flow projections and prevents cash shortages despite strong revenue forecasts.

- Technology & Automation – Utilize revenue forecasting software, CRM software, and AI-driven analytics to collect historical data, speed up revenue forecasting, reduce manual errors and enhance prediction accuracy.

- Monitor Key Performance Indicators (KPIs) – Track metrics such as utilization rates, revenue per billable hour, client acquisition costs, and churn rates to refine forecasting models. Collect data on past performance to make your predictions more accurate and estimate revenue with confidence.

- Be Conservative but Realistic – Future revenues might not be as high as you think. Avoid overly optimistic projections that could lead to overspending or resource misallocation. Balance ambition with realistic data to predict future revenue accurately.

Revenue Forecasting Mistakes – Avoid Them and Forecast Revenue Accurately

Professional services firms live and die by their ability to forecast revenue. Although there are many types of forecasting that service firms perform, they all tie into an underlying revenue forecast. Get your revenue forecasting right, and you have an appropriately sized firm that has a healthy service mix. Make revenue forecasting mistakes, and you will be under or over staffed in key areas and suffer from low utilization rates, high turnover, or a general lack of direction regardless of market conditions.

This is why revenue forecasts are so important. Unfortunately, they don’t always receive the attention they deserve.

One thing that separates high-performing professional services firms with a solid growth strategy from their peers is their ability to reliably make revenue projections. While there is no one size fits all approach, we will dive into common resource-driven revenue forecasting mistakes that services firms make along their journey to the top. These mistakes often arise at companies that are growing rapidly, or simply do not have the proper tools to model their business.

Predict future revenue with certainty – common forecasting mistakes

Underestimating Demand

Many companies fail to accurately predict the true demand for their services, often due to an incomplete understanding of project scope, sudden client requests, or last-minute changes. This results in resource shortages, delays, and overworked employees, ultimately impacting service quality and client satisfaction.

Solution: Regularly communicate with clients and project teams to anticipate changes in demand. Use historical project data, market trends, and sales pipeline analysis to build a more accurate demand forecast. Implement scenario planning to prepare for unexpected surges in workload.

Overestimating Capacity

Some firms assume that their workforce operates at full capacity without accounting for factors like vacations, sick leaves, training, and administrative responsibilities. This can lead to overcommitting to projects, causing burnout, missed deadlines, and dissatisfied clients, as well as affecting future revenues.

Solution: Track actual employee availability, considering factors such as leave policies and non-billable activities. Use resource management tools that provide visibility into real-time workload and adjust project commitments based on realistic capacity planning.

Ignoring Historical Data

Companies often neglect to analyze past project performance, leading to inaccurate resource planning. Without leveraging historical data, firms may repeat past mistakes, misallocate resources, or underestimate the time needed for project completion.

Solution: Maintain detailed records of past project timelines, utilization rates, and employee performance. Use data analytics and forecasting software to identify patterns and improve future predictions. Regularly review past forecasts versus actual outcomes to refine accuracy.

Lack of Collaboration in Forecasting

Forecasting done in silos—without input from project managers, sales teams, and HR—leads to a misalignment between available resources and project demands. This results in scheduling conflicts, inefficiencies, and poor service delivery.

Solution: Foster cross-departmental collaboration by implementing a shared resource planning system. Hold regular meetings where sales, HR, and project managers align on upcoming workloads, skill gaps, and hiring needs to create a more comprehensive forecast.

Static Forecasting Models

Relying on a one-time forecast without regularly updating it based on real-time project and business conditions leads to outdated and inaccurate planning. Static forecasting fails to adapt to shifts in client needs, market conditions, or workforce changes.

Solution: Adopt a dynamic forecasting approach that updates regularly with real-time data. Utilize cloud-based resource planning tools that allow continuous tracking and automatic adjustments based on changing conditions. Implement rolling forecasts instead of static annual planning.

Failure to Consider Employee Attrition

Employee turnover is an inevitable factor, but many companies fail to incorporate it into resource planning and forecasting revenue. When key employees leave unexpectedly, projects can be delayed, or quality can suffer due to inexperienced replacements, making it harder for managers to predict future revenue.

Solution: Factor in expected attrition rates based on company trends and industry benchmarks. Develop succession plans and cross-train employees to ensure continuity. Use workforce analytics to predict attrition risks and proactively hire or upskill staff when needed.

Neglecting Skills Alignment

Assigning resources without considering whether they have the right skills for a project can result in inefficiencies, poor quality work, and lower client satisfaction. This mistake often occurs when companies focus solely on availability rather than expertise.

Solution: Maintain a skills inventory database that tracks employees’ expertise, certifications, and project experience. Use skill-based forecasting models to match the right people with the right projects. Provide continuous training to bridge skill gaps and enhance workforce flexibility.

How to Choose the Tool for Revenue Projections?

Accurate revenue predictions depend on more than just historical data and past performance of your projects. To predict future revenue based on this information, you also need an accurate tool. But what should such tool have?

To ensure the accuracy of the quantitative forecasting methods and revenue projections and predict future accurately, your tool should include:

- Built-in project budgeting module, with predicted and real costs and incomes,

- Extensive module for employee’s wages, with various types of contracts (i.e. regular employee, contractor, etc.),

- Different types of billing methods for projects (i.e. time and material projects, fixed price projects, maintenance projects),

- Comprehensive accounting module with settlements,

- Various project reports for finances, as well as finances combined with tracked hours and progress.

Only these features combined can provide you with all the details you need to create an accurate revenue projections, sales forecast or revenue growth prediction.

If you are interested in finding all of these features right away and creating accurate revenue forecasts, look no further and start a trial with BigTime or let us show you how to manage historical data and revenue prediction in minutes during a BigTime Demo.