What are the overhead costs?

Overhead costs are all the continuing expenses of running the business, excluding the direct costs of developing a product or providing a service, or so-called operating expenses.

In the case of the IT service company, overhead costs are typically the indirect costs of everything except for the work of employees themselves, as they are responsible for providing a service to a customer. Everything supporting them in doing so is generally considered an additional expense.

Types of overhead costs

To make things a bit easier, overheads in IT service companies are typically divided into two categories: project overhead and company or administrative overhead.

Here are some examples of overhead costs.

Project overheads

Project overheads are all the additional costs linked directly to your project that you need to cover to complete the project. Naturally, just like in the definition of overheads, that does not include the costs of work. Importantly, project overheads only impact the profitability of the project they were generated in - other projects do not need to cover any share of these costs.

Company overheads

On the other hand, company or business overhead is a much broader category. It generally includes all the expenses the business has to cover to keep running smoothly, such as the operating costs (i.e., marketing, sales, administration, executive management) and basic bills (i.e., rent for office space, utilities, taxes, office supplies, other office equipment, advertising expenses, but also essential items and devices, such as printers, paper, and new equipment).

Importantly, these overheads are not directly linked to any specific project running in your company. In many cases this will be fixed overhead costs.

As every billable project benefits from company overheads (for example: workshops for your employees to improve their skills), these expenses are always shared proportionally between the project. To do that, you must allocate overhead costs using the cost allocation formula.

Is salary an overhead expense?

The answer to this question is: it depends on what the business overhead costs cover, and what are they responsible for.

What defines overhead costs?

The employee’s position and current situation in the company is what separates salaries from overhead costs. Generally, if the employee’s work is billable - a customer pays for it - their wage is not an overhead cost.

Still, putting that theory into practice is a bit more complicated. Therefore, we have prepared a few simple examples illustrating the most popular cases you may encounter in the IT company.

Is a developer's salary an overhead cost?

To answer this question, we need to consider two cases: a developer actively working on a billable project and a currently benched developer.

As long as the developer is involved in commercial projects, their salary is not an overhead cost, as it is directly responsible for generating profits for the company - in other words, their work is billable, and the customer pays for it.

However, there are some cases in which a developer's salary can be included in the sum of overheads. For example, when a developer is benched or is assigned to a non-billable or internal project, their work does not contribute to the company’s profits. Therefore, their salary is overhead.

Is marketing salary an overhead cost?

Yes - marketing salaries are generally an overhead cost.

Marketing activities are not directly responsible for delivering products or services and generating profits from any of the projects. Therefore, they are included in the company overheads. The same applies to other administrative salaries, such as sales, legal expenses and accounting fees.

Is the CEO's or executive’s salary an overhead expense?

Yes. High-level managers, just like the members of support departments, are not directly involved in work on commercial, billable projects. As such, their salaries are overhead costs by definition.

Why should you keep track of overheads - even if they don’t impact your project directly?

While they may seem small in some cases, the overhead costs can drastically alter the costs of a project, or even turn it unprofitable altogether. These are not just empty words - here’s how it works in the real world.

How does project profitability change with overheads?

Imagine a project a customer pays $150 000 for. The work in the project is estimated to cost $50 000, leaving the company with a 66% profit margin.

Still, this project also needs to cover $60 000 of monthly overheads, as determined by using cost allocation formula. After deducting both the costs of work and overheads from the income, the project generates $40 000 in profits. Therefore, its final profit margin is around 26% - much less than the initial one!

How can I keep track of overhead expenses at all times?

With so many types of overhead expenses, calculating overhead costs is sometimes difficult - at least in spreadsheets or other makeshift solutions. However, some solutions are better suited to staying on top of all the additional costs. Primetric is one of them!

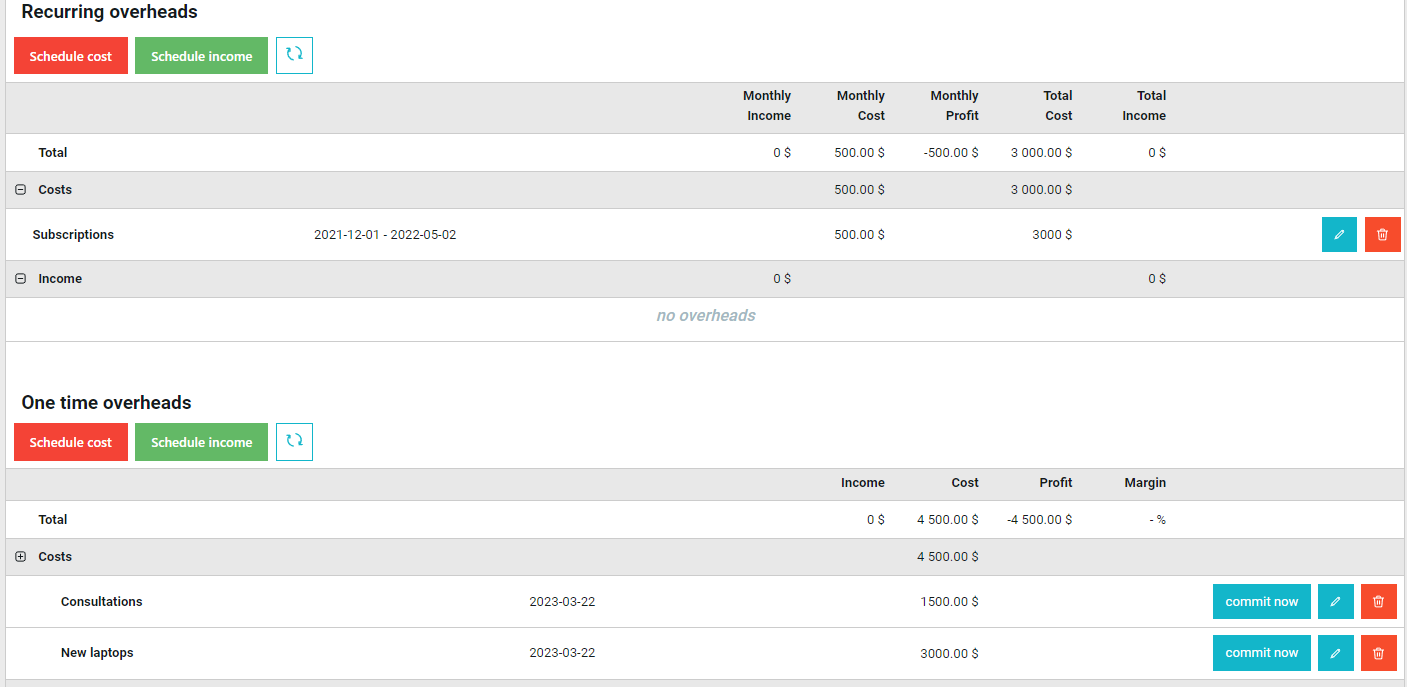

In Primetric, you can add both recurring and one-time overheads to your projects and monitor their impact on profitability of the operation. Further on, you can also include company overheads to the equation and share them between all of your projects.

As a result, you can gain a complete picture of all the expenses in your company and access realistic financial forecasts and calculations - all in just a few clicks!

Do you want to monitor your overhead expenses like IT leaders?

No problem - there’s an easy way to do that.

First, familiarize yourself with our other articles about profitability and overhead cost, including the ones about:

- managing project costs,

- revenue projection,

- budgeting mistakes ruining your profit margins,

- improving the profitability of an IT company,

- including overheads in the price of billable hours,

- calculating overhead cost per team member.

...and learn to calculate overhead costs and manage indirect and direct expenses in your business.

Or, if you already need help with your business's overhead expenses, you can do them in Primetric. Book a demo or start a trial with our tool to see its potential for financial processes!

.JPG)